Former Padres Paying the Price for Living Longer

Dick Sharon

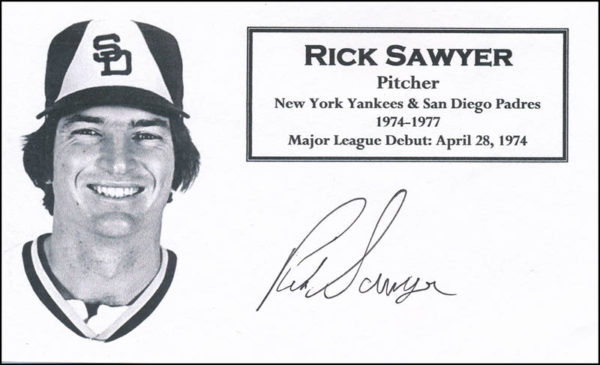

A new report released last week does not bode well for onetime San Diego Padres’ players Dick Sharon and Rick Sawyer.

According to the World Economic Forum (WEF), on average, men in the United States can outlive their personal savings by eight years. The WEF report goes on to conclude that pension and government welfare systems and retirement savings globally have not kept pace with longer life expectancies.

Now why does that matter? Because the life expectancies of baseball players have actually been found to be higher than that of the general population. Compared to the average 20-year-old U.S. male, an MLB player can expect to live almost five additional years of life, according to the results of a research study published in a 2008 edition of Social Sciences Quarterly. The study found that career length is inversely associated with the risk of death, likely because those who played our national pastime are more apt to be physically fit.

Sharon, who earned $16,000 when he played for the Padres in 1975, turned 69 on Tax Day (April 15). Sawyer earned $19,000 playing for the Padres in 1976 and $23,500 playing for the team in 1977; he turned 71 in April.

Significantly, neither man receives a Major League Baseball (MLB) pension.

All they have been getting since 2011 are non-qualified retirement payments of $625 for every 43 game days they were each on an active MLB roster, up to a maximum payment of $10,000.

Meanwhile, a vested retiree can receive up to $225,000, according to the IRS.

A total of 630 former MLB players are in this position because the rules for receiving MLB pensions changed in 1980. They don’t receive a pension because they didn’t accrue four years of service credit. That was what ballplayers who played from 1947 to 1979 needed to be eligible to be vested.

However, since 1980, all you’ve needed is one game day of service to be eligible to buy into the league’s health insurance coverage plan and 43 game days for a pension. The problem is, nobody from the MLBPA insisted at the time that this change be made retroactive.

To make matters worse, the non-qualified retirement payment cannot be passed on to a surviving spouse or designated beneficiary. So when Sawyer passes, that money he’s now receiving doesn’t go to his wife, Theresa.

To date, the MLBPA, which would be responsible for going to bat for these men during collective bargaining negotiations with the league, has been loath to divvy up anymore of the collective pie to help these men. Even though the current players’ pension and welfare benefits fund is valued at more than $3.5 billion, MLBPA Executive Director Tony Clark has never commented about these non-vested retirees, many of whom are filing for bankruptcy at advanced ages, having banks foreclose on their homes and are so sickly and poor that they cannot afford adequate health care coverage.

Instead, Clark is enriching the people who work at the union’s offices at 12 East 49th Street in New York City. According to the MLBPA’s own IRS filing, the 72 staff members working for the union in 2015 earned $16 million. Clark leads the way, getting $2.1 million on top of his own MLB pension.

We put a great premium on helping the future generation in this country. But let’s have a little healthy respect for our seniors too. Clark and the union should go to bat for the men like Sharon and Sawyer— they’re the ones who helped grow the game by standing on picket lines, going without paychecks and enduring labor stoppages all so guys like Manny Machado and Eric Hosmer could sign their million dollar free agent contracts to play for San Diego now.

Freelance magazine writer.

Advocate for MLB players rights

Tony Clark looks out for; himself first, current MLB players second, and then nobody. He cries all the time during MLB / player negotiations about unfair it is, but outside of that bubble, nothing. This article doesn’t surprise me.

Why are we begrudging this happening in baseball when it’s rampant country-wide?

What do you think is happening with the post office, any other labor union (School districts, hospitals, metal workers etc), and people that can’t afford to save for retirement? Sawyer played 10 years in the minors and MLB. Retired at 30, with about 40 years of working/earning/savings potential. Many people are getting to 30 with advanced degrees today and have gargantuan debt with terrible job prospects.

Who should be responsible for people not planning ahead and not taking into account their full situation? Themselves (Capitalism), the government (Socialism), or their employer as part of their pay (AKA still an employees job to know, seek and stay with that employer and would demand that people get paid minimum 15% less across the board) even at the potential expense of the company failing? And, what happens if that company fails?

This is a fundamental economic question. Just because those 2 guys played for the Padres for a couple years we’re now hearing about them when millions of senior citizens are in the same or far worse off shape.

Someone in the MLBPA needs to step up for these guys and their families. If they helped to make MLB what they are today, they deserve it.

I believe in unions and there power to help employees get a decent living, but too many of their “leaders” could give a ssss about the members who TrueType need them fighting for them. Shame MLBPA Executive Director Tony Clark And his cronies! Those that care about the least able to help them don’t deserve their positions they hold!!!!