Former Padres Not Being Helped by MLB

The short URL of the present article is: https://www.eastvillagetimes.com/eoly

Any San Diego Padre fans remember Bill Laxton? A pitcher who spent parts of the 1971 and 1974 seasons with the Padres, Laxton turns 70 in January 2018.

How about Jim Wilhelm? An outfielder who played for the Padres during parts of the 1978 and 1979 seasons, Mr. Wilhelm appeared in 49 games during his career. He came up to bat 122 times and collected 32 hits, including six doubles and three triples. He scored 10 runs and knocked in 12.

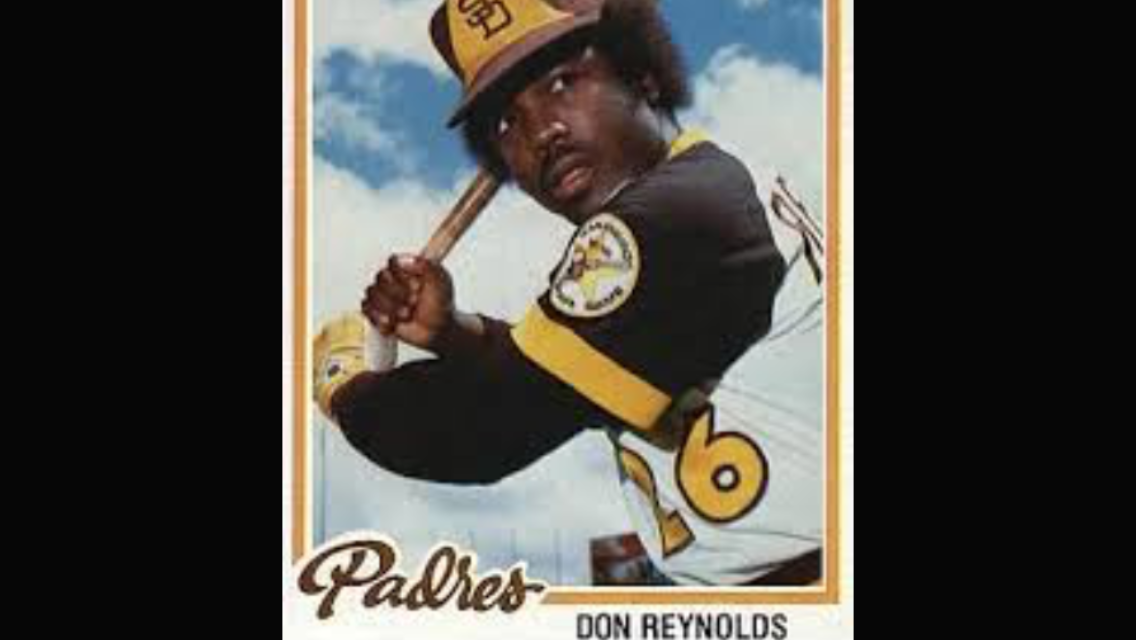

What about Don Reynolds? An outfielder who, like Wilhelm, spent parts of the 1978 and 1979 seasons with the Padres, Reynolds appeared in a total of 87 career games. He came up to the plate 132 times, collected 32 hits, including three doubles and two triples, and had 16 runs batted in. He also scored 14 runs.

All three men — Laxton, Wilhelm and Reynolds — have another thing in common besides being former Padres.

They are all retired big leaguers who don’t receive pensions for having played Major League Baseball (MLB).

See, the rules for receiving MLB pensions changed in 1980. These men and 500 other retirees do not get pensions because they didn’t accrue four years of service credit. That was what ballplayers who played between 1947 and 1979 needed to be eligible for the pension plan.

Instead, they all receive non-qualified retirement payments based on a complicated formula that had to have been calculated by an actuary.

In brief, for every quarter of service a man had accrued, he’d get $625. Four quarters (one year) totals $2,500. Sixteen quarters (four years) amounts to the maximum, $10,000. And that payment is before taxes are taken out.

What’s more, the payment cannot be passed on to a spouse or designated beneficiary. So neither Wilhelm’s wife, Kathleen, nor Laxton’s wife, Cheryl, will continue to receive that payment when their husbands die.

These men are also not eligible to be covered under the league’s umbrella health insurance plan.

They are clearly being penalized for playing the game they loved at the wrong time.

The irony? Laxton’s son, Brett, does receive a pension. He pitched in the big leagues in 1999 and 2000. He only appeared in nine career games, starting three of them. He only pitched 26 and one-third innings.

His father is credited with having worked 243 and one-third career innings. Bill Laxton appeared in 121 games, all but four of them in relief. He won three games and saved five others.

Yet he gets squat.

But I’m saving the best for last.

Now the Northwest Director of Scouting for the Arizona Diamondbacks, here’s the thing about Don Reynolds that is so intriguing — his kid brother is Harold Reynolds.

Yes, THAT Harold Reynolds.

Don Reynolds is seven years older than Harold, who was the lead studio analyst for ESPN’s Baseball Tonight program from 1996 to 2006. Currently the co-host of Hot Stove for MLB Network, he earned his first ever Sports Emmy Award for Outstanding Sports Personality – Studio Analyst in 2013.

It is believed Harold Reynolds has never publicly commented or taken a stance about whether the pre-1980 players such as his brother should get real pensions from the organization that pays his salary.

Wow.

According to the IRS, the maximum allowable pension a vested retiree who played after 1980 can receive is $210,000. Even post-1980 players who only have 43 game days worth of credit reportedly receive a pension worth $34,000.

To date, the union representing the current players, the Major League Baseball Players Association (MLBPA), has been loathe to divvy up anymore of the collective pie. Even though Forbes recently reported that the current players’ pension and welfare fund is valued at $2.7 billion, MLBPA Executive Director Tony Clark — the first former player to ever hold that position, by the way — has never commented about these non-vested retirees, many of whom are filing for bankruptcy at advanced ages, having banks foreclose on their homes and are so sickly and poor that they cannot afford adequate health care coverage.

Makes you think, doesn’t it? About fairness and equity.

Freelance magazine writer.

Advocate for MLB players rights